costa rica taxes for us expats

Earned Income Tax Rate. Tax International based in San Jose Costa Rica specializes in helping US.

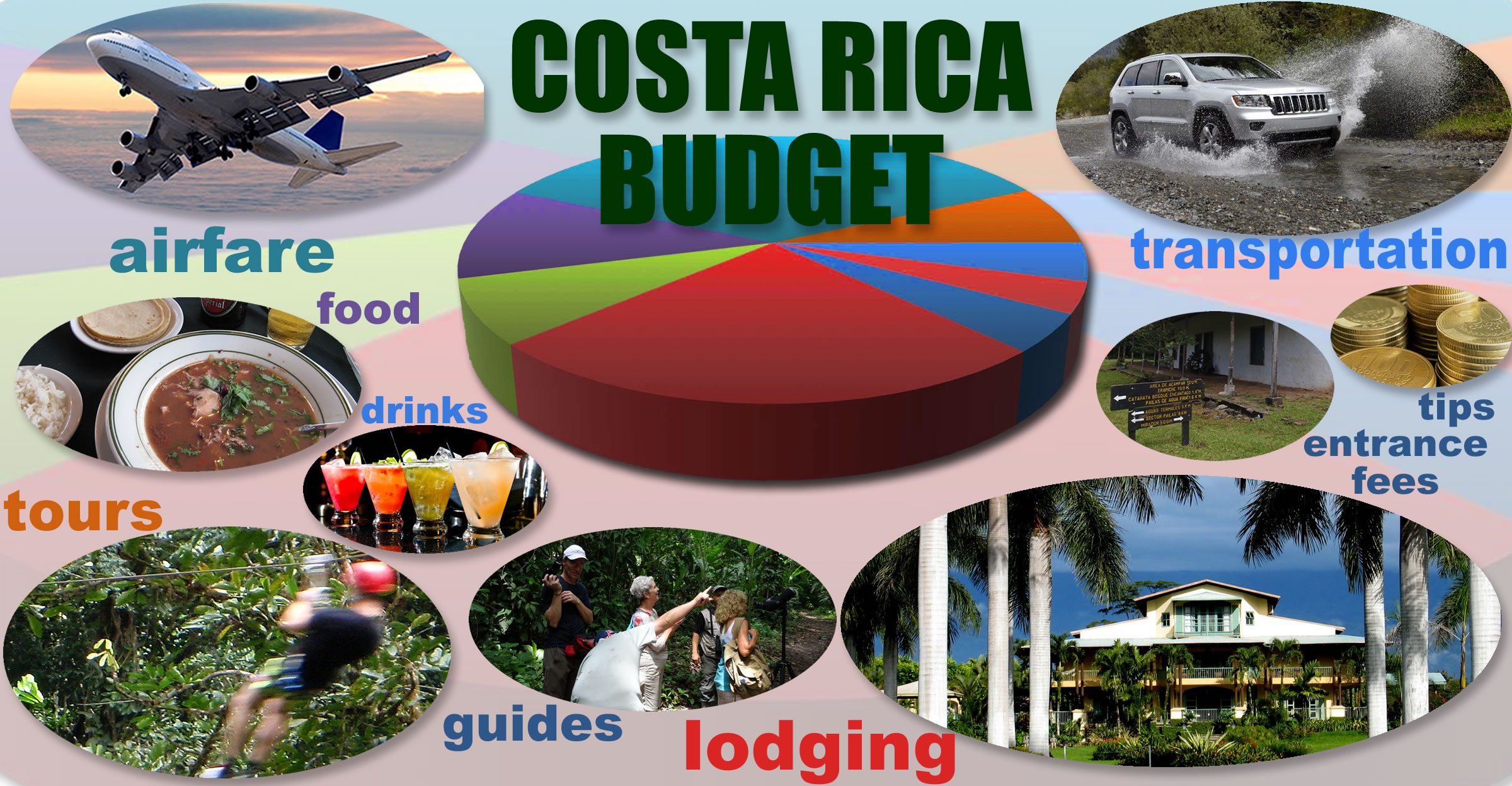

How To Live In Costa Rica On A Budget

Citizens living overseas comply with.

. Expats living in San Jose Costa Rica only pay Costa Rican taxes on any income they may have that originates in Costa Rica but US taxes on their worldwide income. Costa Rica didnt have a capital gains tax except for developers until 2019. The exception is gasoline and imported products.

Costa Rica Taxes Tax Saving Tips for US Expats. Foreign Tax Credit When it comes to US expat tax in Costa Rica most US expatriates worry about double taxation paying taxes to two different countries the US. Whether you want to or not you must eventually think of doing your taxes.

Here are the main types of taxes you have to pay in Costa Rica depending on how you make money. While there are many different countries that US Person Expats travel to in recent years Costa Rica has become one of the most popular. It allows you to exclude.

A lot of people I know spend between. From the cool climate of the Central Valley to the beautiful. Between 714000 and 1071000 10.

Up to 714000 Exempt. Expats in Costa Rica talk about the best places for families to live in Costa Rica. 13 Best Places for Families to Live in Costa Rica.

In general everything in Costa Rica is around 35 percent cheaper than in the US. Tax and Accounting Services Company based in San Jose Costa Rica. The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value per year.

The taxation rate for salaried employees in Costa Rica for a tax year 2013 is as follows. When property is purchased in Costa Rica it. Easy Costa Rica Tax Guide for US Expats Abroad.

Employees in Costa Rica contribute 917 of their earning to the Costa Rican social security system. 1 The Foreign Earned Income Exclusion for Costa Rica expats. The capital gains charge is 15 for residential properties and 30 for commercial properties.

A US citizen who works abroad can usually claim the Foreign Earned Income Exclusion. Some people will prepare their own returns others will hire.

How Can Future Expats Go Native In Costa Rica Godutch Realty

How To Claim Foreign Sales Tax On An Income Tax Return Income Tax Return Income Tax Income

Retire In Costa Rica Best Places Costs Social Security Residency Taxes Playas Del Coco Properties Costa Rica Real Estate

Retire In Costa Rica Best Places Costs Social Security Residency Taxes Playas Del Coco Properties Costa Rica Real Estate

3 Realistic Options To Become A Resident Living In Costa Rica Mexico Real Estate Costa Rica

Why The Cost Of Living In Costa Rica Is Totally Worth It

The Cost Of Groceries Costa Rica Vs Usa 2019 Godutch Realty Real Estate For Costa Rica

How U S Expats Can Earn 103 900 Tax Free Livingbetter50 Beach Communities International Living Beach Town

Moving Abroad 101 Move Abroad Abroad Living Abroad

Pin By Susan Young On Costa Rica In 2022 Alajuela South Pacific Puntarenas

Tax Requirements And Compliance For Vacation Rentals In Costa Rica Caribbean Property Management Services In Costa Rica Green Management

Retire For Less In Costa Rica July 20 2019 Retire For Less In Costa Rica

Climate In Costa Rica Microclimates Seasons And Regional Weather In 2022 Costa Rica Costa Puntarenas

Retire In Costa Rica Best Places Costs Social Security Residency Taxes Playas Del Coco Properties Costa Rica Real Estate

Panama Vs Costa Rica The Tropical Titans Fight It Out

Costa Ballena Costa Rica Real Estate Market Report For 2020 2021 Osa Tropical Properties

Taxes Archives Page 6 Of 10 The Tico Times Costa Rica News Travel Real Estate

Retiring In Costa Rica The Complete Guide

Expat Retirement Living The Tico Times Costa Rica News Travel Real Estate